The Union Budget 2025 presented by Finance Minister Nirmala Sitharaman brought forth pertinent relief measures for India’s middle-class taxpayers. By taking the bold step of eradicating income tax from earnings up to ₹12 lakh and restructuring tax slabs, the government is planning to reduce the burden on salaried individuals, boosting economic growth.

New Income Tax Slabs for FY 2025-26

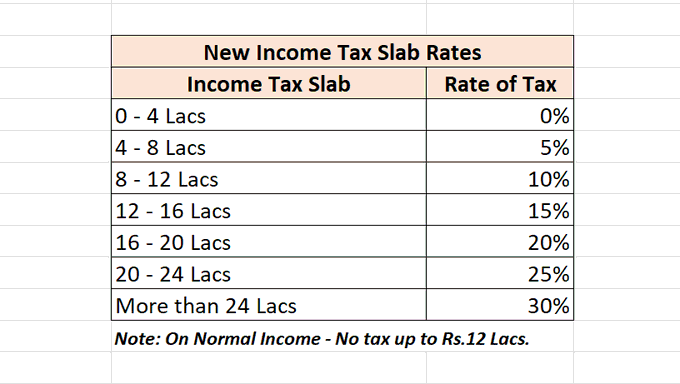

Income tax slabs under the new tax regime, as per the revised slabs are as under:

| Income Range (₹) | Tax Rate (%) |

|---|---|

| 0 – 4 lakh | Nil |

| 4 – 8 lakh | 5% |

| 8 – 12 lakh | 10% |

| 12 – 16 lakh | 15% |

| 16 – 20 lakh | 20% |

| 20 – 24 lakh | 25% |

| Above 24 lakh | 30% |

This new design ensures that those with a total income of up to ₹12 lakh will have zero tax liability due to the rebate and reduced slab rates.

Tax Payable for Different Salary Levels

| Gross Salary (₹) | Tax (₹) | Rebate (₹) | Education Cess (₹) | Final Tax Payable (₹) |

|---|---|---|---|---|

| 10,00,000 | 32,500 | 32,500 | 0 | 0 |

| 15,00,000 | 93,750 | 0 | 3,750 | 97,500 |

| 20,00,000 | 1,85,000 | 0 | 7,400 | 1,92,400 |

| 25,00,000 | 3,07,500 | 0 | 12,300 | 3,19,800 |

| 30,00,000 | 4,57,500 | 0 | 18,300 | 4,75,800 |

How Much Will You Save? The tax cuts offer considerable savings to individuals across different income levels:

- ₹12 lakh income – Tax relief of ₹80,000, completely obliterating tax liability.

- ₹18 lakh income – Tax relief of ₹70,000, nearly 30% of tax payable as per the previous rates.

- ₹25 lakh income – Tax relief of ₹1,10,000, reducing the tax liability by about 25% as compared to the previous rates.

Comparison of Tax Payable (Old vs New Regime)

| Salary Income (₹) | Tax Payable (Old Regime) | Tax Payable (New Regime) |

|---|---|---|

| 10,00,000 | ₹44,200 | ₹0 |

| 15,00,000 | ₹1,30,000 | ₹97,500 |

| 20,00,000 | ₹2,78,200 | ₹1,92,400 |

| 25,00,000 | ₹4,34,200 | ₹3,19,800 |

| 30,00,000 | ₹5,90,200 | ₹4,75,800 |

(Source: Taxmann)

Other Tax Sops

In addition to the tax slabs, the following are the tax reliefs announced by Budget 2025:

- TDS on Rent: The threshold for Tax Deduction at Source (TDS) on rent has been increased from ₹2.40 lakh per annum to ₹6 lakh per annum, benefiting small taxpayers and easing compliance burdens.

- Senior Citizen Benefits: The limit for tax deduction on interest for senior citizens has been doubled from ₹50,000 to ₹1,00,000.

- TCS on Remittances: The TCS threshold on remittances under the RBI’s Liberalized Remittance Scheme has been enhanced from ₹7 lakh to ₹10 lakh. Another change is the abolition of TCS on remittances for education purposes, which are funded through loans.

The Budget 2025 brings much-needed relief to the middle class with tax rate reductions and increased rebates, particularly benefiting those earning up to ₹12 lakh. Additionally, the relaxation in TDS and TCS rules, along with increased deductions for senior citizens, further support the government’s vision of reducing tax burdens and promoting financial stability for the common citizen. With these sweeping reforms, taxpayers can look forward to substantial savings in FY 2025-26.