Tata Power vs Adani Power: India’s leading power sector giants, Tata Power and Adani Power, released their Q1 FY26 results on Friday, revealing strong financials despite weaker power demand due to early monsoons and falling merchant tariffs. Both stocks are now in focus as investors evaluate which company holds more long-term value. In this article, we will break down their quarterly performance, strategic directions, and key financial indicators to help you decide which stock might suit your investment goals.

Adani Power Q1 FY26 Results: Strong Profits Despite Challenges

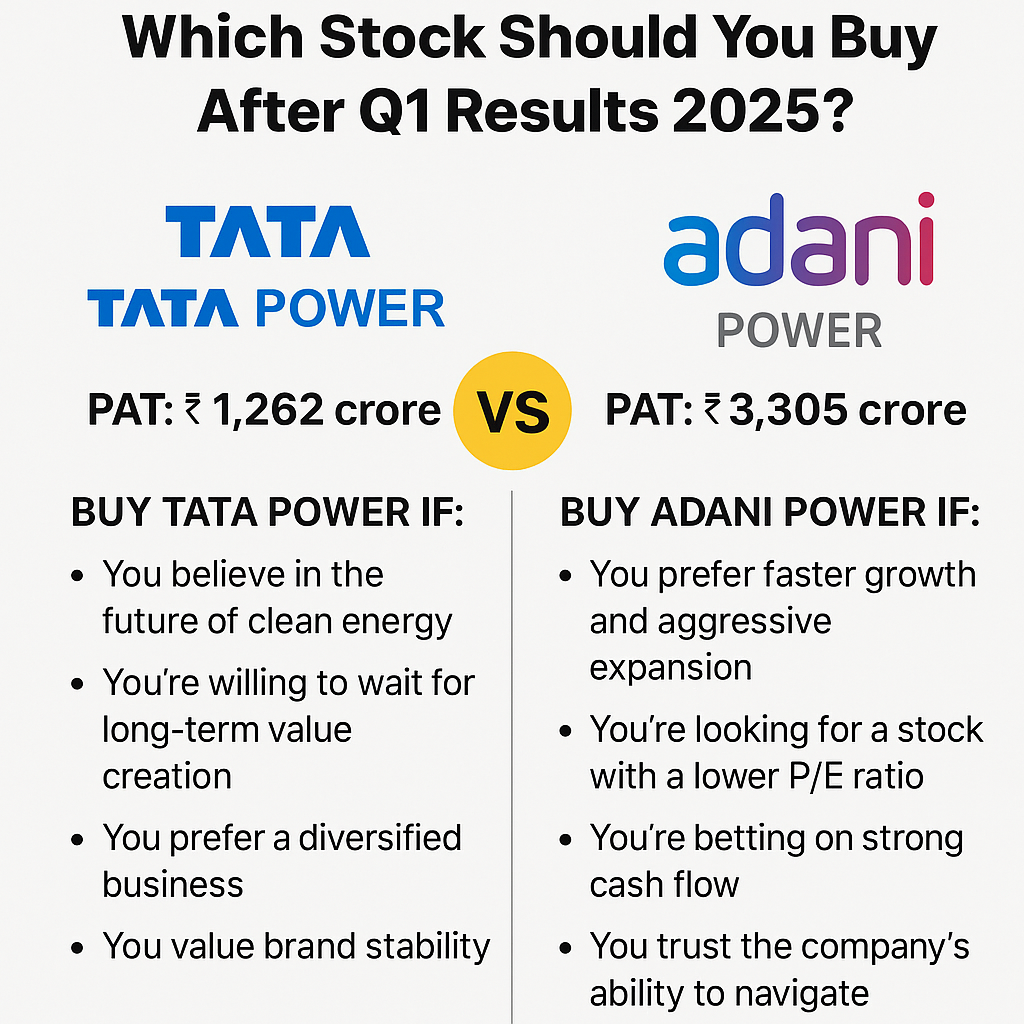

Adani Power reported a Profit After Tax (PAT) of ₹3,305 crore, showcasing a robust performance even though it was slightly below last year’s ₹3,912 crore. Revenue dropped marginally to ₹14,167 crore, mainly due to subdued demand and a dip in merchant tariffs. However, what stood out was the EBITDA of ₹5,744 crore, reflecting healthy operating margins.

Key Strengths of Adani Power:

- Stable revenues backed by long-term Power Purchase Agreements (PPAs).

- Solid execution of projects and strategic acquisitions.

- Expansion targets aiming to reach 30 GW of capacity by 2030.

- Strong international exposure, especially with regular payments from Bangladesh.

Adani Power’s operational efficiency and cost control played a critical role in maintaining profitability, even in a soft quarter. The company is clearly focused on scalability and maintaining its leadership in thermal power production.

Tata Power Q1 FY26 Results: Stability with a Green Future

Tata Power reported a PAT growth of 6% YoY, taking its quarterly profit to ₹1,262 crore. Revenue stood higher at ₹17,464 crore, indicating better topline growth than Adani Power. But the lower profit figure has raised eyebrows.

Despite the modest PAT, Tata Power’s results reflect long-term value creation. This was the company’s 23rd consecutive quarter of profit growth, driven largely by its expanding renewable energy portfolio and rising manufacturing capacity.

Key Strengths of Tata Power:

- 44% of current capacity is renewable, with a goal of reaching 70% by 2030.

- Strong growth in EV charging infrastructure and rooftop solar.

- Presence in power distribution across major Indian cities.

- A proven track record of sustainable, gradual growth.

The company is currently in a transition phase, investing heavily in clean energy projects that may impact short-term profits but position it well for the future.

Expert Views on Tata Power vs Adani Power

According to Seema Srivastava, Senior Research Analyst at SMC Global Securities:

“Adani Power looks more attractive for long-term growth due to its lower P/E ratio (10–15) and rapid expansion plans. Tata Power, while more expensive with a P/E ratio around 32–40, offers diversification and brand stability.”

Gaurav Goel, Founder of Fynocrat Technologies, adds:

“Tata Power’s investment in renewables may be hitting profits now, but it’s building long-term value. Adani Power, meanwhile, is more focused on efficient scaling and capitalizing on existing thermal power strengths.”

Which Stock Should You Buy?

Buy Adani Power If:

- You prefer faster growth and aggressive expansion.

- You’re looking for a stock with a lower P/E ratio.

- You’re betting on strong cash flow and high operating margins.

- You trust the company’s ability to navigate fluctuations in power demand.

Buy Tata Power If:

- You believe in the future of clean energy and sustainable power.

- You’re willing to wait for long-term value creation.

- You prefer a diversified business with interests in EV, solar, and distribution.

- You value brand stability and consistent performance.

A Balanced View

Both Tata Power and Adani Power are strong players with distinct strategies. Adani Power is currently more attractive in terms of valuation and short-term performance. On the other hand, Tata Power is steadily building a future-proof, green-energy-dominated portfolio.

For aggressive investors, Adani Power offers strong near-term potential. For conservative and ESG-focused investors, Tata Power might be the better choice for a stable, long-term play.