Silver prices are once again in the spotlight after extending last week’s record-breaking rally. Supported by a weaker US dollar, falling Treasury yields, and tightening global supplies, the white metal is showing no signs of slowing down. With analysts projecting ambitious targets for the coming year, investors are now asking a crucial question — is ₹2.40 lakh per kg the next stop for silver?

Silver Climbs Sharply on MCX

Silver futures on the Multi Commodity Exchange (MCX) continued their upward momentum on Monday. March silver contracts were trading 1.36% higher at ₹1,95,466 per kg around 9:15 am. This followed a powerful surge in the previous session, when prices jumped by ₹2,700 to touch an all-time high of ₹2,01,615 per kg.

The rally reflects growing confidence in silver’s long-term fundamentals, driven by a combination of macroeconomic and structural factors.

Why Are Silver Prices Rising So Fast?

Strong Industrial Demand and Tight Supplies

According to market experts, the surge in silver prices is being fueled by tightening inventories and rising industrial consumption. Silver demand has increased sharply from fast-growing sectors such as solar energy, electric vehicles, and data centres.

Renisha Chainani, Head of Research at Augmont, explained that silver’s move toward the ₹2 lakh mark reflects deeper changes in the market. Inclusion of silver in the US critical minerals list, strong ETF inflows, and aggressive retail buying have all contributed to expectations of a supply deficit next year. Rising leasing rates and higher borrowing costs for physical silver in London also point to ongoing delivery challenges.

Global Supply Pressures Intensify

Adding to the bullish outlook, China has announced fresh restrictions on silver exports starting January 2026. These curbs, which will remain in place until 2027, require exporters to obtain government licences. Analysts believe this policy could further squeeze global supply at a time when inventories are already under strain.

India’s appetite for physical silver is also rising rapidly. Imports crossed 2,600 tonnes during September and October, with October alone accounting for 1,715 tonnes — a clear signal of strong industrial and investment demand.

Fed Policy and Dollar Weakness Support Metals

Silver has also benefited from shifting expectations around US monetary policy. After three consecutive interest rate cuts, the Federal Reserve has indicated one more cut in 2026. However, markets believe the risks are tilted toward further easing, with many analysts forecasting additional 25 basis point cuts in March and June.

A softer interest rate outlook has weakened the US dollar and pushed Treasury yields lower, creating a supportive environment for precious metals.

Silver Outperforms Gold in 2025

Spot silver has already delivered an extraordinary performance this year, rising nearly 126% and gaining close to ₹1,08,000 per kg. The rally has been driven by strong physical demand and persistent global supply shortages.

Gold has also joined the broader commodities rally. MCX February gold futures were trading 0.72% higher at ₹1,34,580 per 10 grams, after hitting a fresh record of ₹1,35,263 last week.

Axis Direct Sees ₹2.40 Lakh Target in 2026

Axis Direct remains firmly bullish on silver’s long-term prospects. The brokerage noted that silver has posted its strongest annual gains since 1979, building on an already strong performance in 2024.

Technical Breakout Signals a New Cycle

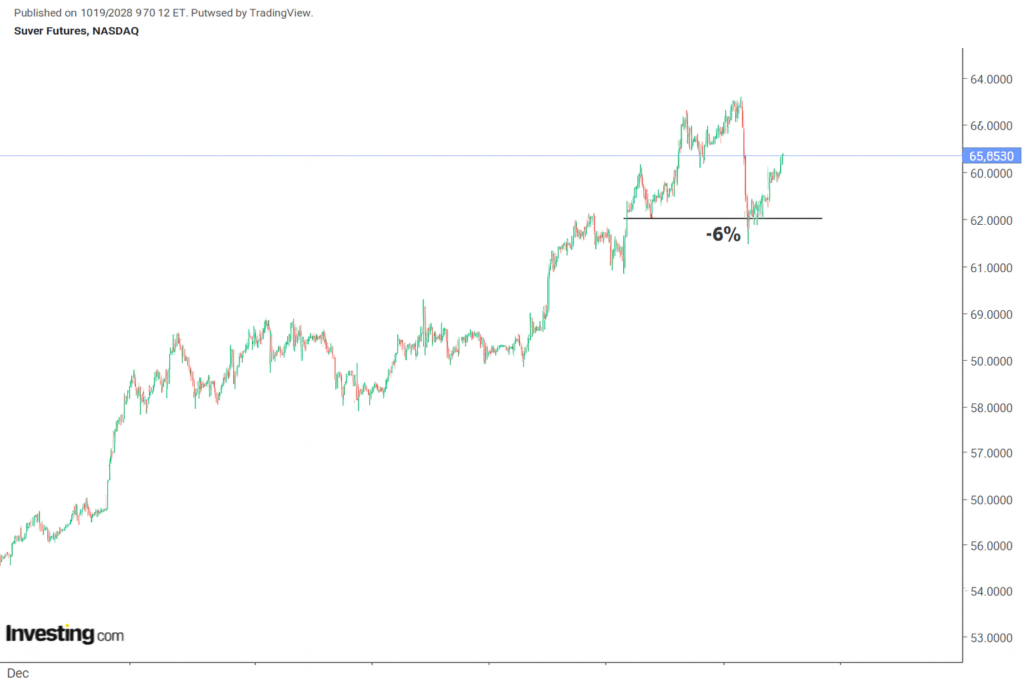

According to Axis Direct, silver has broken out of a massive rounding-bottom pattern that stretched from 2011 to 2025. The metal cleared the critical neckline at $50 and surged to a new all-time high near $64, confirming the start of a long-term bullish cycle.

The brokerage highlighted that both the 20-month and 60-month exponential moving averages have turned upward, a classic signal of an early-stage structural uptrend. While the monthly RSI remains elevated, it is still considered healthy, as silver has historically rallied even in high-RSI zones.

Axis Direct expects silver to test the $65–$67 range in the near term. A sustained move above $67 could open the door to $76–$80 internationally, translating into a domestic target of ₹2.40 lakh per kg in 2026.

Strategy for Investors

The brokerage advises investors to use any corrective dip toward the ₹1,70,000–₹1,78,000 zone as an opportunity for staggered accumulation rather than chasing sharp rallies.

Fundamental Risks Still Exist

Despite the strong outlook, analysts caution that risks remain. Silver prices above $60 per ounce could lead to demand destruction or substitution in certain industrial applications. A slowdown in high-tech electronics or renewable energy investment could also temporarily cap gains.

However, Axis Direct believes the broader structural story remains intact. The silver market has faced a cumulative deficit of nearly 700 million ounces between 2021 and 2025, with the shortfall expected to exceed 100 million ounces in 2026.

Outlook: Is ₹2.40 Lakh Achievable?

Silver’s recent rally reflects more than short-term speculation. It marks a deeper repricing driven by chronic supply shortages, rising industrial dependence, and shifting global trade policies. While volatility is likely along the way, the metal’s long-term trajectory appears firmly upward.

If current trends persist, ₹2.40 lakh may no longer seem ambitious — it could simply be the next chapter in silver’s historic bull run.