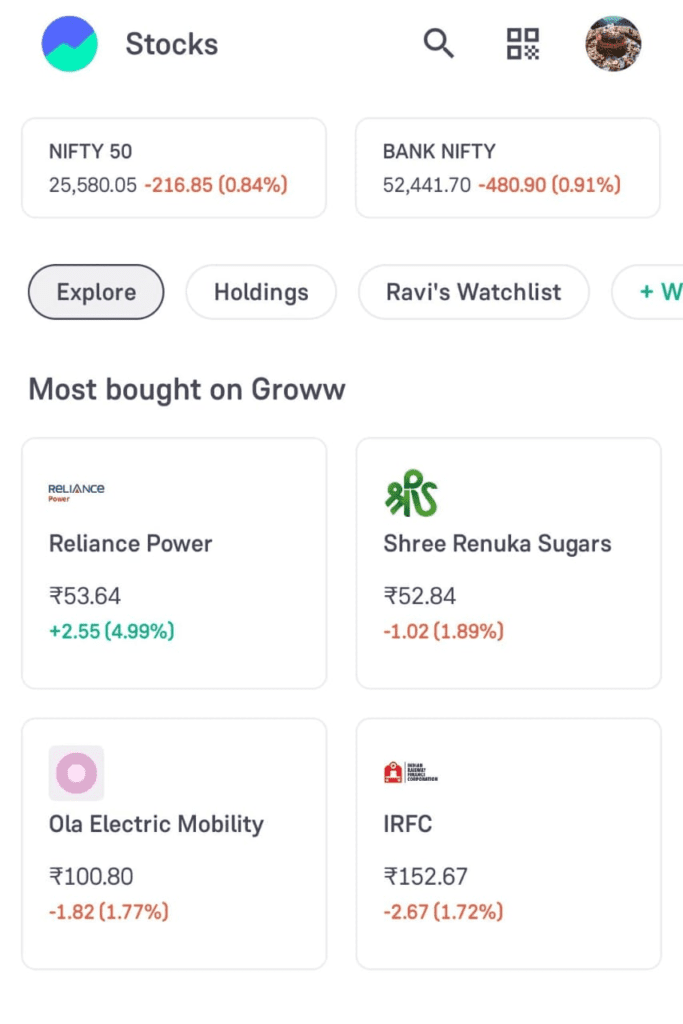

Share Market Today News: On October 3, 2024, the Indian share market experienced a significant dip as global and domestic factors combined to create a bearish sentiment. Both the Sensex and Nifty saw major declines, leaving investors concerned.

Share Market Today News: Major Indices Performance

- Sensex: The BSE Sensex tumbled by 770 points, currently trading at 83,504.

- Nifty: Similarly, the NSE Nifty dropped by 242 points, reaching 25,556.

This sharp decline marks one of the steepest falls this week, contributing to an overall loss of approximately 2,500 points since the beginning of the week.

Sectoral Impact

Today’s downturn hit several key sectors, with Auto, Energy, and Banking stocks bearing the brunt of the losses:

- M&M, Tata Motors, and Maruti Suzuki witnessed a 2% drop in their share prices.

- Bank stocks also struggled as financial institutions faced headwinds from global uncertainty and rising valuations.

Share Market Today News: Nifty’s Top Gainers

Despite the overall bearish sentiment, a few stocks managed to make gains:

| Stock | Current Price (₹) | Increase (₹) | Change % |

|---|---|---|---|

| Tech Mahindra | 1,623.00 | 45.80 | 2.90% |

| Mahindra & Mahindra | 3,168.00 | 73.10 | 2.36% |

| Britannia | 6,452.15 | 114.00 | 1.80% |

These stocks, driven by strong fundamentals, managed to defy the broader market trend and ended in positive territory.

Nifty’s Top Losers

On the downside, several heavyweight stocks took a hit, reflecting the general market sentiment:

| Stock | Current Price (₹) | Decrease (₹) | Change % |

|---|---|---|---|

| IndusInd Bank | 1,409.15 | 38.45 | -2.66% |

| ONGC | 292.40 | 5.20 | -1.75% |

| Asian Paints | 3,275.00 | 54.10 | -1.63% |

Share Market Today News: Reasons for the Market Fall

Share Market Today News: There are several factors contributing to the recent market downturn:

- Iran-Israel Tensions: The escalating conflict in the Middle East, with rising concerns over a potential war between Iran and Israel, has led to negative global sentiment. Investors are growing cautious, pulling funds from riskier assets, which has affected not only the Indian market but global markets as well.

- High Market Valuations: Indian markets have seen significant gains over the past few months, especially in the mid and small-cap segments. However, many analysts believe the market is overvalued, and the recent corrections are a natural consequence of these stretched valuations.

- US Recession Fears: Increasing fears of a potential recession in the United States have led to volatility in global markets. The impact of a US recession could slow down global economic growth, which is now reflecting in stock market performances worldwide, including in India.

Global Market Overview

- Nikkei (Japan): +2.24%

- Hang Seng (Hong Kong): -2.43%

- Kospi (South Korea): -1.22%

In the US, markets saw a relatively stable day on 2 October:

- Dow Jones: +0.09%, closed at 42,196.

- Nasdaq: +0.08%, closed at 17,925.

- S&P 500: +0.01%, closed at 5,709.

What Lies Ahead for Investors?

Given the ongoing global uncertainties and fears of a potential economic slowdown, investors are advised to remain cautious in the near term. Experts suggest focusing on quality stocks with strong fundamentals and avoiding highly speculative bets until the market shows signs of stability.

The next few days will be crucial, especially as global geopolitical tensions and economic data from the US continue to influence market movements. Keep a close watch on the Middle East situation, as it could heavily impact global crude oil prices and overall market sentiment.

For now, short-term volatility seems inevitable, but long-term investors could view these dips as opportunities to enter strong stocks at lower valuations. As always, a balanced portfolio approach is recommended to weather this turbulent period.

Upcoming IPO to Watch

Amidst the market volatility, Garud Construction & Engineering Limited is set to open its IPO on 8 October, with bidding open until 10 October. The company will be listed on the BSE and NSE by 15 October.

Conclusion

Today’s market fall has once again highlighted the interconnected nature of global and domestic markets. With geopolitical tensions and economic uncertainties dominating the landscape, investors are advised to tread carefully and keep a diversified portfolio.

Stay updated with market trends and keep a close eye on key economic and geopolitical developments in the coming days.