RBI MPC Meeting April 2025: The Reserve Bank of India reduced the repo rate by 25 basis points to 6% and changed the policy stance to ‘accommodative’ to support economic growth.

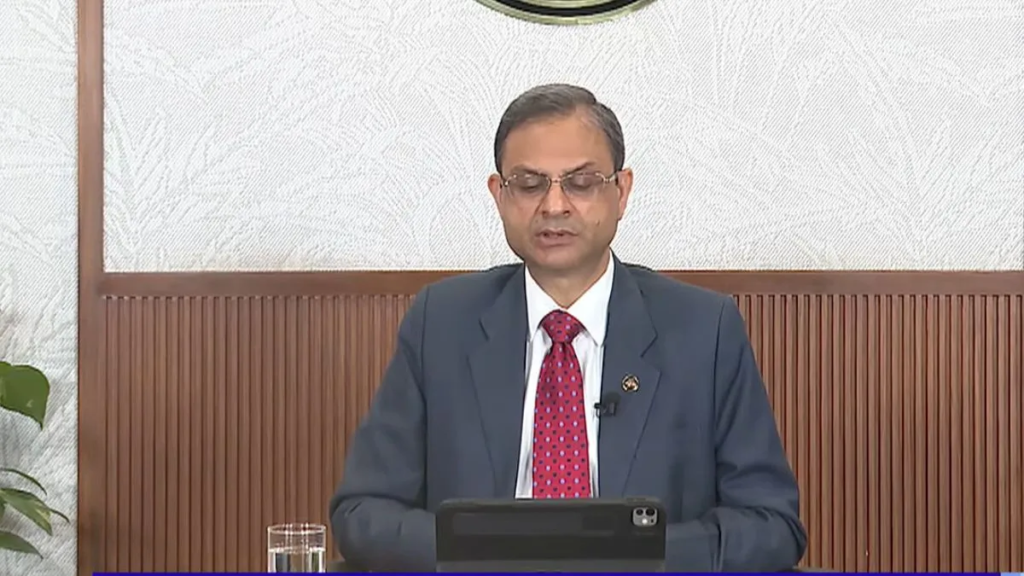

New Delhi, April 9, 2025 —In a major policy move, the Reserve Bank of India (RBI) has reduced the repo rate by 25 basis points to 6%, marking a significant step to boost economic momentum amid rising global uncertainties. The decision was announced by RBI Governor Sanjay Malhotra at the conclusion of the three-day Monetary Policy Committee (MPC) meeting held from April 7 to 9.

Governor Malhotra, while addressing the media, emphasized that the policy stance has also been shifted from ‘neutral’ to ‘accommodative’, signaling the central bank’s intention to support economic activity while keeping inflation under control.

“This decision comes in response to rising concerns over a possible global slowdown, triggered by renewed trade tensions and tariff hikes by the United States,” said Malhotra.

Key Announcements from the April 2025 RBI MPC Meeting:

- Repo Rate cut: 25 basis points reduction to 6.00%

- Standing Deposit Facility (SDF): Reduced to 5.75%

- Marginal Standing Facility (MSF) and Bank Rate: Reduced to 6.25%

- Policy Stance: Changed to ‘accommodative’ from ‘neutral’

This move follows a similar rate cut in February 2025, when the MPC reduced the repo rate from 6.5% to 6.25%, marking the first interest rate cut in nearly five years.

Experts believe that the RBI’s proactive stance is aimed at countering the impact of weak global demand and maintaining domestic financial stability. Analysts also see this as a step toward making borrowing cheaper for both consumers and businesses.

“With inflation currently within the RBI’s comfort zone and economic indicators showing early signs of strain, this accommodative stance is a welcome move,” said Dr. Meena Sinha, a senior economist at IndiaGrowth Analytics.

The RBI’s April 2025 policy meeting was keenly watched by investors, economists, and market participants, given the volatile global economic environment. The repo rate cut is expected to have a positive impact on home loans, car loans, and other lending instruments, potentially spurring demand in the months to come.

What It Means for You:

- EMIs on loans might come down

- Cheaper credit for businesses

- Boost for real estate and auto sectors

The central bank’s dovish tone has sent a strong message to the markets — that it stands ready to support growth without compromising financial stability.

As the world continues to grapple with economic challenges, all eyes will now be on how the Indian economy responds to this fresh dose of monetary support.

This is a developing story. Stay tuned for more updates.