Lenskart IPO Day 2 Subscription Status: The initial public offering (IPO) of Lenskart Solutions Ltd continued to attract strong investor interest on Day 2, with the issue subscribed 1.60 times by 12:30 PM, according to data from the BSE.

Retail investors and institutional buyers led the enthusiasm, with the retail portion subscribed 2.61 times, NII (non-institutional investors) 1.24 times, and QIB (qualified institutional buyers) bidding 1.45 times. The employee quota was also oversubscribed at 2.11 times.

Price Band and Issue Details

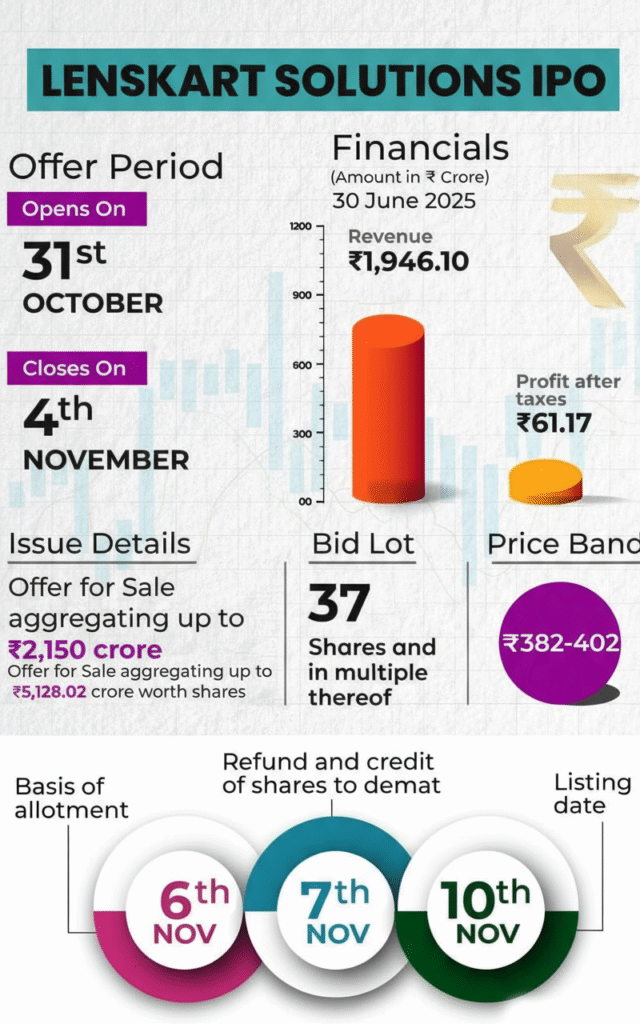

The Lenskart IPO is open for subscription from October 31 to November 4, 2025, with a price band of ₹382–₹402 per share. The company aims for a valuation of around ₹69,700 crore at the upper price limit.

The IPO comprises a fresh issue of ₹2,150 crore and an offer for sale (OFS) of 12.75 crore equity shares from promoters and investors.

Promoters including Peyush Bansal, Neha Bansal, Amit Chaudhary, and Sumeet Kapahi, along with global investors like SVF II Lightbulb (Cayman) Ltd, Schroders Capital, PI Opportunities Fund-II, and Kedaara Capital, will be partially offloading their stakes through this public issue.

Lenskart IPO GMP Today: ₹85 Premium in Grey Market

The grey market premium (GMP) for Lenskart IPO today stands at ₹85, indicating strong listing expectations. At this premium, the estimated listing price could be around ₹487 per share, representing a 21% gain over the upper issue price of ₹402.

In the past week, Lenskart’s GMP has shown consistent momentum — rising from ₹48 to a high of ₹108 — reflecting investor optimism about its growth story and brand strength.

How Lenskart Plans to Use IPO Proceeds

Lenskart plans to use the fresh issue proceeds for capital expenditures related to setting up new company-owned and company-operated (CoCo) stores across India.

Funds will also go toward lease and licensing costs, technology and cloud infrastructure upgrades, marketing initiatives, potential acquisitions, and general corporate purposes.

Company Overview

Founded in 2008 by Peyush Bansal, Lenskart began as an online eyewear brand in 2010 before expanding into offline retail. Its first physical store opened in New Delhi in 2013.

Today, the company operates across major metropolitan cities, tier-1 and tier-2 markets, and has expanded internationally into Southeast Asia and the Middle East.

Brokerage Views: Subscribe for Long-Term Gains

Leading brokerages remain optimistic about Lenskart’s long-term prospects.

SBICAP Securities noted that Lenskart is well-positioned to capture the growth potential in India’s underpenetrated eyewear market. “We recommend investors to subscribe for the long term at the cut-off price,” the brokerage said, highlighting the company’s improving EBITDA margins — from 7.0% in FY23 to 14.7% in FY25.

Similarly, SMIFS has also given a ‘Subscribe’ rating, citing Lenskart’s return to profitability, technology-driven retail model, and huge addressable market — with 65% of India’s population affected by vision-related issues.

Analyst Verdict: Should You Subscribe?

With its strong brand recall, omnichannel presence, improving profitability, and positive grey market signals, Lenskart IPO presents a promising opportunity for investors looking at long-term growth.

While short-term volatility in listing cannot be ruled out, most analysts suggest subscribing at the cut-off price for those with a 2–3 year investment horizon.

Key Highlights:

- Issue subscribed: 1.60x on Day 2

- Retail quota: 2.61x subscribed

- Price band: ₹382–₹402 per share

- IPO GMP today: ₹85 (≈ ₹487 expected listing price)

- IPO open: Oct 31 – Nov 4, 2025

- Fresh issue: ₹2,150 crore + OFS of 12.75 crore shares

- Brokerage rating: Subscribe for long-term

- Disclaimer:

The Lenskart IPO continues to generate buzz in the market with a robust Day 2 subscription and a healthy GMP premium. Experts believe the company’s technology-driven retail model, expanding store network, and improving financial performance make it a strong candidate for long-term investors seeking exposure to India’s fast-growing consumer retail sector.