Indian stock market news today: The Indian stock market witnessed a significant selloff, as the Sensex and Nifty 50 fell by over 1%. Mid and small-cap indices saw declines of up to 1.85%, resulting in a market cap loss of ₹9 lakh crore.

Indian stock market news today: On Monday, November 4, the Indian stock market experienced a sharp, across-the-board selloff. The Sensex and Nifty 50 benchmarks each plunged nearly 1.85%, while the mid-cap and small-cap segments dropped more than 2%.

The Sensex opened at 79,713.14, slightly below its previous close of 79,724.12, and tumbled over 1% to hit 78,349. Similarly, the Nifty 50 began trading at 24,315.75, compared to its prior close of 24,304.35, and declined to 23,847.

Meanwhile, the BSE Midcap and Smallcap indices also fell by up to 2%.

This widespread dip led to a decrease in the total market capitalisation of companies listed on the BSE, which dropped from ₹448 lakh crore in the last session to nearly ₹439 lakh crore, erasing around ₹9 lakh crore in investor wealth in a single day.

Sectoral Indices Performance Today

Among sectoral indices, Nifty Oil & Gas, Media, Consumer Durables, and Realty saw declines of 2-3%, while Nifty Bank, Auto, FMCG, Metal, and PSU Bank indices each fell by around 1%.

Indian stock market news today: Factors Behind Today’s Market Downturn

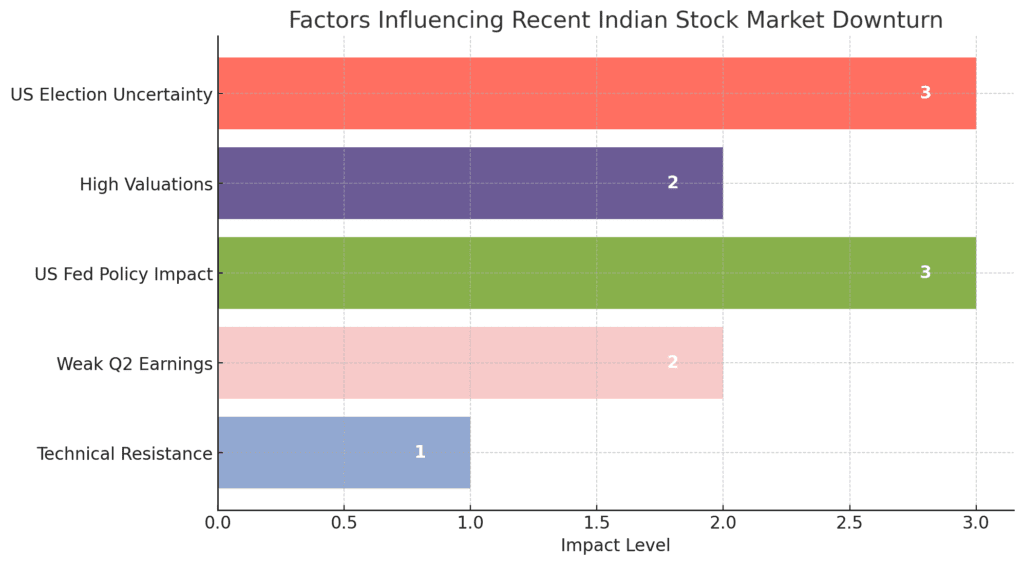

Experts have identified five major factors contributing to today’s market slide:

- Caution Ahead of the U.S. Election

The market is displaying nervousness linked to the upcoming U.S. presidential election. With opinion polls suggesting a close race between Democratic candidate Kamala Harris and Republican Donald Trump, uncertainty looms over the outcome.

Global markets will likely focus on the U.S. election over the next few days, which may cause short-term volatility. Nonetheless, this is expected to be temporary, as economic fundamentals like U.S. growth, inflation, and Federal Reserve actions will ultimately guide market direction,” said V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

- Valuations Remain High

Despite recent market corrections, valuations are still viewed as stretched. Data from Trendlyne shows that the current price-to-earnings (PE) ratio of the Nifty 50 is 22.7, slightly above its two-year average of 22.2 and matching its one-year average of 22.7.

“The recent correction hasn’t meaningfully reduced the high valuation multiples across the broader market. These are likely to persist due to India’s long-term growth outlook,” noted Pankaj Pandey, Head of Research at ICICI Securities. “However, on a stock-specific level, the situation has improved as some stocks have seen sharper corrections.”

- Impact of the U.S. Federal Reserve

The U.S. Federal Reserve’s policy decision, set for November 7, is anticipated to bring a 25-basis-point rate cut, although experts believe this is largely priced in. “While a 25 bps cut is expected, the potential for high government spending by both U.S. election candidates points to a rising fiscal deficit, leading bond yields to climb higher, which isn’t favorable for the market,” explained Pankaj Pandey.

- Disappointing Q2 Earnings

The September quarter results for India Inc. have underperformed, adding to investor caution over market prospects.

“Earnings have shown softness, primarily due to weaker performance in the commodities sector, which is dampening market sentiment,” Pandey noted.

“The Indian market is facing challenges from a slowdown in earnings growth. With Nifty’s earnings per share (EPS) growth expected to fall below 10% in FY25 based on Q2 results, sustaining current valuations—about 24 times projected FY25 earnings—may be difficult,” stated Vijayakumar. “This sluggish earnings environment could drive Foreign Institutional Investors (FIIs) to continue selling, limiting any significant market recovery.”

- Technical Challenges

Market experts highlight that the Indian stock market has recently struggled to break free from a downward trend due to a lack of new positive triggers.

Anand James, Chief Market Strategist at Geojit Financial Services, observed that the 24,150 level provided strong support last week, helping to prevent further declines. However, upward momentum remains weak, facing resistance within the 24,470-24,540 range, with further obstacles at 24,660-24,770.

“We anticipate these resistance levels will be tested this week, but for the trend to decisively shift, Nifty would need to sustain multiple closes above 25,100. Otherwise, the current ‘sell on rallies’ pattern is likely to persist,” James noted. “Failure to hold above 24,470 or a break below 24,150 could lead to a drop toward 23,900-23,300, suggesting that Nifty 50 may soon move beyond the 24,150-24,470 range.”