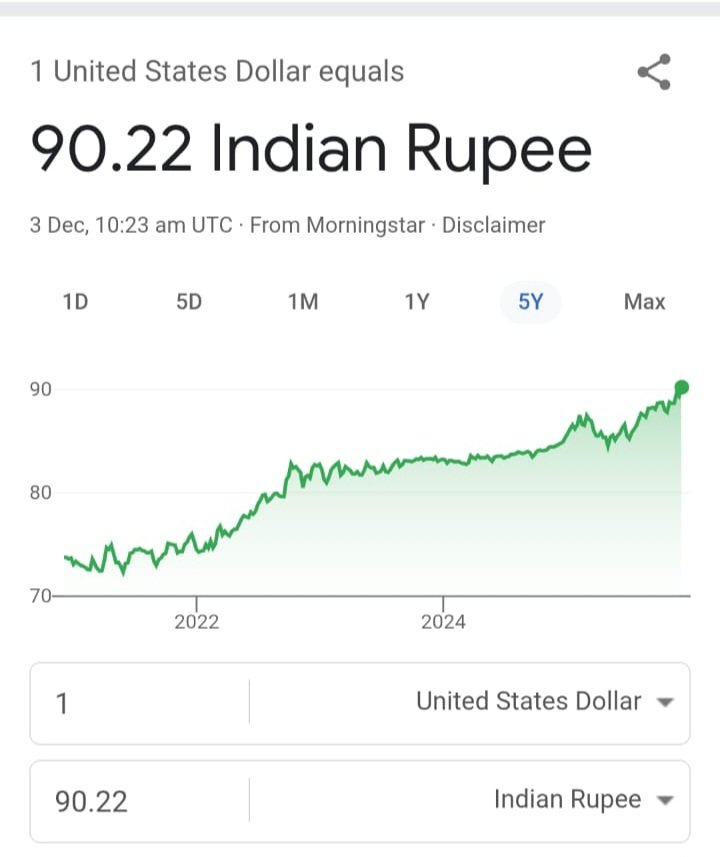

The Indian rupee slipped to a new all-time low of 90.58 against the US dollar during early trade on Monday, reflecting mounting pressure from uncertainty surrounding the India–US trade negotiations and continued foreign institutional investor (FII) outflows.

The domestic currency opened weaker at 90.53 per dollar at the interbank foreign exchange market and soon extended losses to touch 90.58, marking a depreciation of 9 paise from its previous close.

Persistent Weakness Continues After Friday’s Fall

Rupee Extends Losing Streak

The rupee has been on a steady downward trajectory. On Friday, it had already fallen 17 paise to close at 90.49, which was then its lowest-ever closing level against the American currency.

Forex market participants said the sentiment around the rupee remains cautious and risk-averse, with traders adopting a wait-and-watch approach until there is greater clarity on global trade developments.

India–US Trade Deal Uncertainty Weighs on Sentiment

Investors Remain Cautious

According to forex traders, uncertainty over the India–US trade deal continues to weigh heavily on market sentiment. Investors are hesitant to take aggressive positions, leading to sustained pressure on the domestic currency.

In addition, persistent foreign fund outflows from Indian equity and debt markets have further weakened the rupee’s outlook in the near term.

Global Factors Add to Currency Pressure

Dollar Index and Crude Oil Prices

The dollar index, which measures the greenback’s strength against a basket of six major currencies, was trading 0.05% lower at 98.35. Despite the marginal dip, the US dollar remained firm enough to keep emerging market currencies, including the rupee, under strain.

Meanwhile, Brent crude oil prices — a key factor for India, which imports most of its oil — rose 0.52% to USD 61.44 per barrel in futures trade. Higher crude prices tend to widen India’s trade deficit, adding further pressure on the rupee.

Equity Markets Trade in the Red

Sensex and Nifty Slip

Weak global cues and currency concerns also impacted domestic equity markets. The Sensex declined 298.86 points to 84,968.80, while the Nifty fell 121.40 points to 25,925.55 during early trade.

Market experts noted that continued volatility in currency markets could influence investor sentiment across asset classes in the short term.

Outlook: Volatility Likely to Persist

Analysts believe the rupee may remain volatile in the near future, tracking developments on the trade negotiation front, global dollar movements, crude oil prices, and foreign fund flows. Any positive breakthrough in trade talks or easing of global uncertainties could provide temporary relief, but structural pressures remain.