In a landmark moment for global markets, Nvidia Corporation has become the first Nasdaq-listed company to achieve a $5 trillion market capitalization. The milestone was reached on Tuesday after the chipmaker’s shares surged nearly 5%, closing at an all-time high of $201.03 on NASDAQ.

The rally marks an incredible growth streak for Nvidia. The stock has delivered 84.4% returns in the past six months and 44.27% over the last year, cementing its position as the driving force behind the global artificial intelligence revolution.

Why Nvidia Stock Is Soaring

Nvidia’s market momentum is being fueled by its dominance in the artificial intelligence (AI) hardware sector. The company recently announced $500 billion worth of orders for its next-generation AI processors — a signal of unprecedented demand from global tech and defense institutions.

Adding to the optimism, Nvidia revealed plans to build seven new supercomputers for the U.S. Department of Energy (DoE). These systems will play a critical role in maintaining and advancing the nation’s nuclear capabilities. The most powerful among them — being co-developed with Oracle — will run on 100,000 Blackwell AI chips, making it one of the world’s most advanced computing systems.

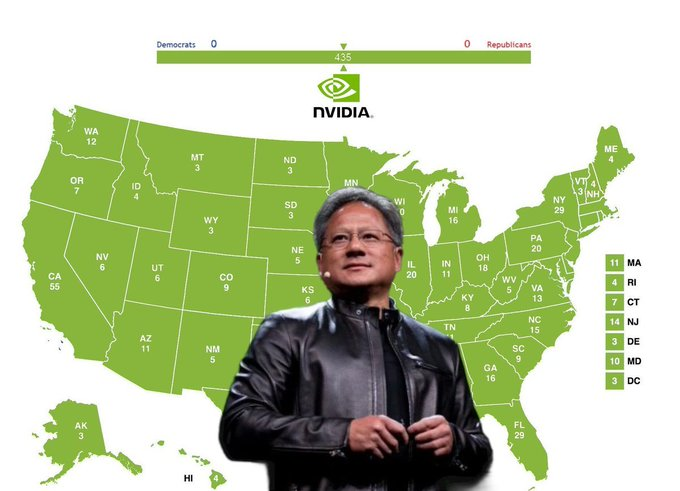

During his keynote address in Washington, D.C., Nvidia CEO Jensen Huang praised U.S. President Donald Trump’s economic policies while unveiling the company’s latest innovations and partnerships. Huang emphasized Nvidia’s commitment to supporting the U.S. in its ongoing technological competition with China.

Nvidia Expands AI Partnerships

Beyond government contracts, Nvidia is strengthening its footprint in global telecom and networking sectors. The company recently announced a $1 billion investment in Nokia, acquiring a 2.9% stake in the Finnish telecom giant.

The strategic partnership aims to co-develop next-generation 6G technology, combining Nvidia’s AI capabilities with Nokia’s networking infrastructure expertise. Together, they plan to advance AI-driven networking solutions and integrate Nokia’s data center switching and optical technologies into Nvidia’s future AI platforms.

Nvidia Surpasses Microsoft and Apple

With its latest milestone, Nvidia has officially become the most valuable Nasdaq-listed company in history.

Trailing behind, Microsoft now ranks second with a $4 trillion market capitalization, while Apple briefly crossed the same mark earlier this week before closing slightly lower at $3.99 trillion.

The surge in valuations reflects the AI-driven reshaping of global markets, as investors pour billions into companies leading the next wave of digital transformation.

What Lies Ahead for Nvidia

As demand for AI processors accelerates across industries — from cloud computing to defense — Nvidia remains at the epicenter of the world’s technological race. Analysts believe the company’s aggressive expansion into government contracts, next-gen computing, and telecom infrastructure positions it for continued dominance.

However, experts also caution that competition from AMD, Intel, and new AI chip startups could intensify in the coming years, testing Nvidia’s ability to maintain its massive market lead.

Summary: Key Highlights

- Nvidia becomes first Nasdaq-listed company to hit $5 trillion market cap

- Stock closes at $201.03, up nearly 5% in a single session

- 84.4% return in six months, 44.27% gain over one year

- $500 billion AI chip orders and seven new U.S. supercomputers announced

- $1 billion investment in Nokia to co-develop AI and 6G technologies

- Microsoft and Apple follow with valuations near $4 trillion

Disclaimer

This article is for informational purposes only and should not be considered financial advice. Readers are advised to consult certified experts before making investment decisions.