The Supreme Court has permitted the CBI to register six more cases into the alleged builder-bank nexus that defrauded thousands of homebuyers across Mohali, Mumbai, Bengaluru, Kolkata, and Prayagraj.

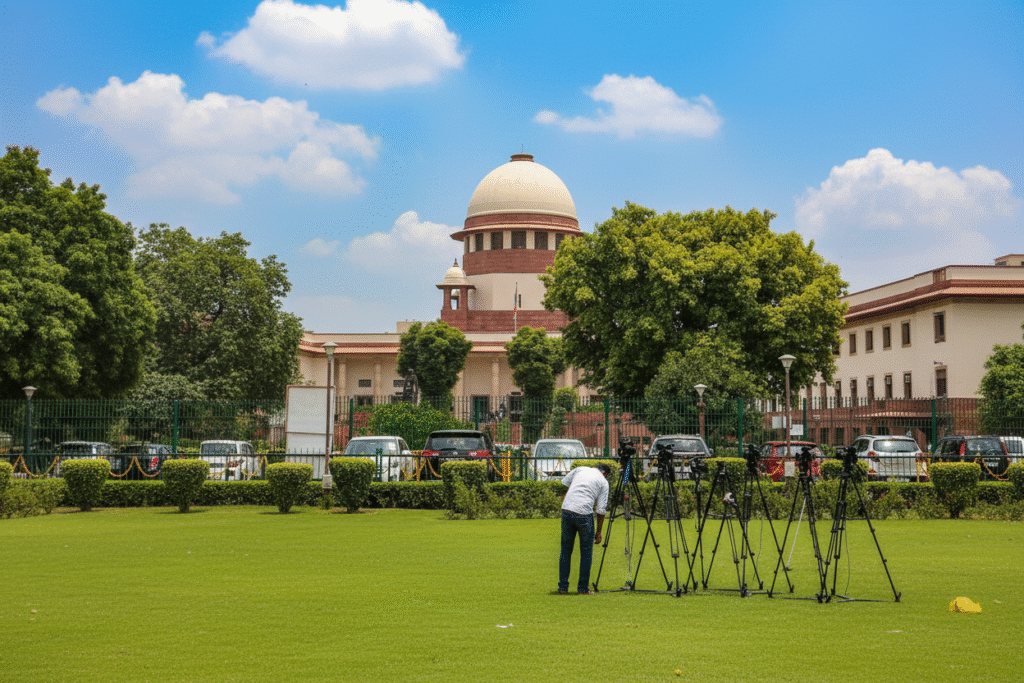

Supreme Court Expands CBI Probe into Builder-Bank Nexus

In a significant development for thousands of distressed homebuyers, the Supreme Court on Tuesday gave the green light to the Central Bureau of Investigation (CBI) to register six more regular cases into the alleged “unholy nexus” between banks and real estate developers. The fraud, which has left scores of families without homes despite years of payments, spans across major cities including Mohali, Mumbai, Bengaluru, Kolkata, and Prayagraj.

The bench comprising Justices Surya Kant, Ujjal Bhuyan, and N Kotiswar Singh noted the submissions made by the CBI that, following a preliminary inquiry, a cognisable offence had been established. This paved the way for the agency to proceed with formal investigations under criminal law.

CBI Confirms Evidence of Fraud

Additional Solicitor General Aishwarya Bhati, appearing for the CBI, informed the court that preliminary inquiries had been completed into multiple real estate projects, except for those involving Supertech Ltd. She added that the agency was ready to move ahead by registering six more regular cases, conducting search operations, and seizing critical documents for further investigation.

The Supreme Court directed that portions of the sealed cover report prepared by the CBI be shared with amicus curiae Rajiv Jain, who has been assisting the court in the matter.

Background: The Subvention Scheme Trap

At the heart of the controversy is the subvention scheme, a financing model that initially seemed beneficial for homebuyers. Under this arrangement, banks directly disbursed sanctioned loans to builders, who in turn were responsible for paying the EMIs until the homes were handed over.

However, when several builders defaulted on these payments, the liability was unfairly transferred to homebuyers—many of whom were left paying EMIs for apartments that never reached possession. This left families financially and emotionally devastated.

Previous Supreme Court Actions

This is not the first time the apex court has intervened. On July 22, the court had already permitted the CBI to register 22 cases involving projects in the Delhi-NCR region, particularly in Noida, Greater Noida, and Gurugram. The court had also expressed concern over the collusion between developers, banks, and development authorities in Uttar Pradesh and Haryana.

On March 29, the Supreme Court allowed the registration of five preliminary inquiries against builders in Noida, Greater Noida, Gurugram, Yamuna Expressway, and Ghaziabad. A separate inquiry was ordered against Supertech Ltd, one of the largest defaulters, following complaints from 799 homebuyers spanning 84 appeals across eight cities.

Supertech and the Larger Builder-Bank Nexus

Amicus curiae Rajiv Jain has described Supertech Ltd as the “main culprit” in the ongoing crisis. According to his report, Supertech secured loans worth ₹5,157.86 crore since 1998, while banks like Corporation Bank allegedly advanced over ₹2,700 crore to various builders under subvention schemes.

The findings highlighted not just the role of builders but also a prima facie collusion between banks, developers, and certain development authorities’ officials, all of whom allegedly conspired to siphon funds at the expense of ordinary homebuyers.

The Way Forward

The court’s directive marks a critical step in widening the investigation beyond NCR to other parts of the country. For thousands of families waiting for justice, the move offers renewed hope that accountability will finally be enforced against those responsible for financial fraud and shattered housing dreams.

As the CBI prepares to file more cases and conduct fresh investigations, the real estate sector, banks, and regulators will be closely watched for how they address systemic loopholes that enabled such large-scale exploitation.

Key Highlights

- Supreme Court permits CBI to register six new cases in Mohali, Mumbai, Bengaluru, Kolkata, and Prayagraj.

- Probe targets the builder-bank nexus that defrauded homebuyers under subvention schemes.

- CBI confirms that cognisable offences were found after preliminary inquiries.

- Supertech Ltd identified as a major offender, with loans worth over ₹5,000 crore.

- Previous investigations include 22 cases in NCR and inquiries against multiple builders.

Conclusion

The Supreme Court’s order reflects growing judicial concern over the plight of homebuyers caught in fraudulent schemes. By authorizing the CBI to expand its probe beyond NCR, the court has sent a strong message that financial crimes involving real estate will not go unpunished.

For homebuyers who have long fought legal battles, the ruling offers a glimmer of justice, even as the road to accountability remains long and complex.