November 6, 2024, 09:33 AM IST

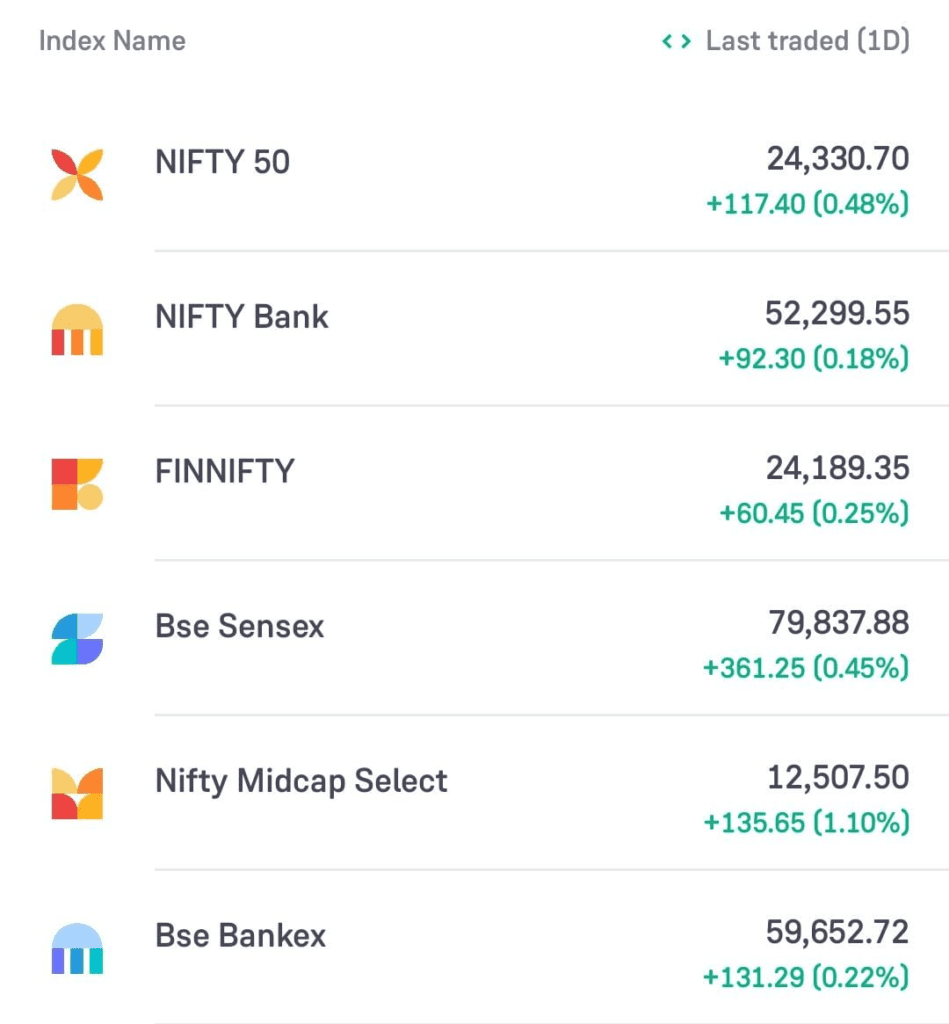

In a positive start to the day, Indian stock market indices Sensex and Nifty 50 opened higher on Wednesday, buoyed by favorable global cues ahead of the highly anticipated 2024 US presidential election results. The Sensex surged by approximately 300 points, while the Nifty 50 crossed the 24,300 mark, supported by an upswing in Asian markets and an overnight rally in the US.

Election-Driven Optimism Boosts Global Markets

With early trends indicating a competitive race between Democratic candidate Kamala Harris and Republican nominee Donald Trump, global markets exhibited an optimistic tone. Initial vote counts showed Trump leading with 53.1% of the popular vote, with Harris close behind at 45.8%. The US stock market posted gains overnight as the world waits to see who will become the 47th President of the United States, impacting not only the US economy but markets worldwide.

Titan Shares Decline Following Q2 Profit Drop

Despite the overall market rally, Titan saw its shares fall over 3% after reporting weaker-than-expected Q2 profits, impacted by a recent cut in customs duty on gold imports. Titan’s stock dropped as much as 3.69% to ₹3,113.65 on the Bombay Stock Exchange (BSE). The company’s disappointing earnings come as a contrast to broader positive market sentiment, highlighting the mixed responses to corporate results.

Expert View: Large-Cap Stability Favored Amid Uncertain Q2 Earnings

Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, noted that the recent rebound in the markets is largely driven by well-valued and stable large-cap banking stocks. He cautioned, however, that ongoing Q2 earnings challenges and lowered FY25 earnings projections could limit a sustained market rally. “Investors should consider using market rallies as an opportunity to shift from high-priced midcaps and smallcaps towards the safer large-cap segment,” he advised.

Sectoral Trends: IT, Realty, and Oil & Gas See Gains; Metals Under Pressure

Among sectoral indices, Nifty IT, Nifty Realty, Nifty Oil & Gas, Nifty Auto, and Nifty PSU Banks were trading in the green, reflecting gains in multiple sectors. In contrast, Nifty Metal and Nifty FMCG showed declines, reflecting sector-specific pressures.

Broader Markets Add to Upside Momentum

The broader market indices also contributed to the market’s upward momentum, with the Nifty Midcap 100 index rising by 0.7% and the Nifty Smallcap 100 up by 0.5% in early trade. Analysts attribute this broad-based support to a favorable shift in investor sentiment, though sector-specific performance remains a significant factor amid ongoing earnings season volatility.

As markets react to evolving election results from the US, investors remain tuned in for further developments and subsequent impacts on the global and Indian economies.