56th GST Council Meeting: GST Council approves Next-Gen GST reforms with three new slabs — 5%, 18% and special 40%. Daily essentials, food items, healthcare, education and automobiles get cheaper, while life & health insurance made GST-free. New rates effective from September 22, 2025.

New Delhi, September 3, 2025 — In a landmark move, the Goods and Services Tax (GST) Council has approved a major overhaul of the tax structure, simplifying the system into three slabs. The decision, taken unanimously during the 56th gst Council meeting chaired by Union Finance Minister Nirmala Sitharaman, is being hailed as one of the most significant tax reforms since GST was rolled out in 2017.

Under the new framework, which will come into effect from September 22, 2025, GST will be levied at 5%, 18%, and a special rate of 40%. The earlier slabs of 12% and 28% have been scrapped, with items redistributed across the revised rates.

What changes for consumers?

Finance Minister Nirmala Sitharaman announced several measures aimed at easing the tax burden on households, farmers, and small businesses. Essential commodities such as ultra-high temperature milk, paneer, and all Indian breads have been moved to the 0% (nil) tax category. Everyday items like hair oil, soaps, shampoos, toothpastes, tableware, noodles, and bicycles will now attract only 5% GST, down from 12% or 18%.

Popular food items including namkeens, sauces, pasta, chocolates, butter, coffee, and ghee have also been shifted from the higher 18% slab to just 5%, offering significant relief to middle-class families.

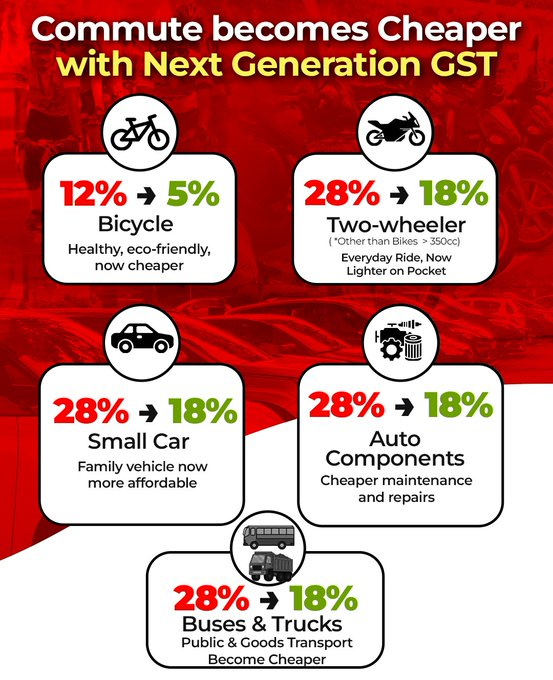

At the same time, goods seen as aspirational purchases for the middle class, such as air conditioners, televisions, dishwashers, and small cars, will now attract an 18% GST instead of the earlier 28%. Auto components, buses, trucks, and ambulances too will be taxed at a uniform 18%.

Meanwhile, a special 40% GST slab has been reserved for products considered harmful or luxury items — including tobacco, pan masala, aerated sugary drinks, and cigarettes.

Relief for farmers and insurance policyholders

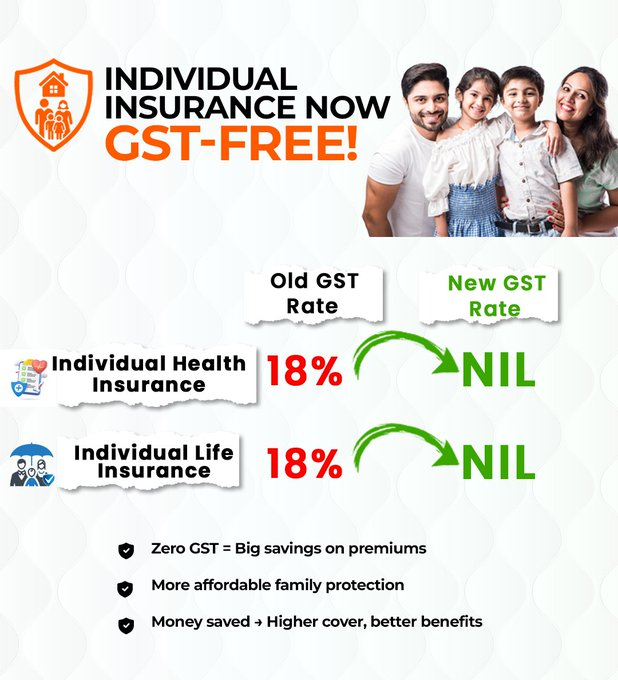

In a consumer-friendly measure, all categories of individual life insurance policies — term plans, ULIPs, endowment policies — as well as health insurance policies will be fully exempted from GST. Sitharaman emphasized that the exemption would bring much-needed relief to families and encourage wider adoption of insurance in India.

She also underlined the benefit to farmers, pointing out that agricultural equipment and essential medical devices have been shifted to the lowest tax slab.

Ministers call it ‘historic’

Punjab Finance Minister Harpal Singh Cheema and Himachal Pradesh ministers Rajesh Dharmani and Harshwardhan Chauhan confirmed that the decision was unanimous, with all states agreeing to the restructuring. “The collective intent was to provide relief to the public,” said Chauhan, stressing the spirit of cooperation in the meeting.

Cheema, however, added that Punjab had urged for an increase in compensation cess for states, which the Centre did not accept.

A structural reform, not just rationalisation

Calling the move “a structural reform”, Finance Minister Nirmala Sitharaman highlighted that the aim was not only to rationalise tax rates but also to simplify compliance for businesses. “This will give relief to common people and ensure that businesses, especially small enterprises, find it easier to operate,” she said.

Prime Minister Narendra Modi welcomed the decision, stating: “Wide-ranging GST reforms will improve lives, ensure ease of doing business, and empower small enterprises.”

Effective from September 22

The revised GST structure will be implemented starting September 22, 2025, coinciding with the beginning of Navratri, a symbolic gesture underscoring the government’s intent to provide relief at a festive time.

With this major reform, India’s indirect tax regime takes a decisive step towards simplification, with promises of boosting consumption, reducing inflationary pressures, and making compliance easier for businesses across the board.

Save Big on Daily Essentials

| Items | From | To |

|---|---|---|

| Hair Oil, Shampoo, Toothpaste, Toilet Soap | 18% | 5% |

| Butter, Ghee, Cheese & Dairy Spreads | 18% | 5% |

| Processed Foods like Pasta, Noodles, Sauces | 18% | 5% |

| Packaged Breads, Rotis | 5% | 0% |

| Packaged Milk, Paneer, Curd | 5% | 0% |

| Sanitary Napkins, Diapers for Babies & Adults | 12% | 5% |

| Sewing Machines & Parts | 18% | 5% |

Uplifting Farmers & Agriculture

| Items | From | To |

|---|---|---|

| Tractor Tyres & Parts | 18% | 5% |

| Pesticides | 18% | 5% |

| Fertilizers | 12% | 5% |

| Hand Tools for Agriculture | 18% | 5% |

| Equipments for Irrigation, Forestry, Poultry & Dairy | 18% | 5% |

Relief in Healthcare Sector

| Items | From | To |

|---|---|---|

| Individual Health & Life Insurance | 18% | 0% |

| Medical Oxygen | 18% | 5% |

| Biodegradable Sanitary Napkins | 12% | 5% |

| Orthopedic Implants & Stents | 12% | 5% |

| Corrective Spectacles | 12% | 5% |

Automobiles Made Affordable

| Items | From | To |

|---|---|---|

| Petrol / Diesel Hybrid, LPG / CNG Cars (≤ 1500cc) | 28% | 18% |

| Small Cars (≤ 300cc Motorcycles) | 28% | 18% |

| Buses, Trucks & Ambulances | 28% | 18% |

| Auto Parts | 28% | 18% |

| Electric Vehicles | 12% | 5% |

| Uniform Rate on all Categories of Goods | 28% | 18% |

Affordable Education

| Items | From | To |

|---|---|---|

| Maps, Charts & Globes | 12% | 5% |

| Children’s Drawing & Colouring Books | 12% | 0% |

| Exercise Books & Notebooks | 12% | 0% |

| Erasers, Rulers & Educational Tools | 12% | 5% |

Save on Electronic Appliances

| Items | From | To |

|---|---|---|

| Air Conditioners | 28% | 18% |

| Refrigerators | 28% | 18% |

| Washing Machines | 28% | 18% |

| Dishwashing Machines | 28% | 18% |

| Televisions (Up to 70 inches) | 28% | 18% |